Original | Odaily Planet Daily (@OdailyChina)

Author | Ding Dang (@XiaMiPP)

A flash crash has happened again.

On the night of January 31, Bitcoin briefly fell below $78,000, hitting a low of $75,700, with a 24-hour drop of 7.6%. This decline was not only extremely rapid but, more critically, it directly broke through the price range where BTC had been consolidating for nearly three months, retreating to lows not seen since April 2025.

The situation for ETH is even more concerning, with its price falling below the $2,400 mark, a 24-hour plunge of 12.28%, almost completely erasing all gains since July 2025. Solana was not spared either, with its price dropping below $100, a single-day decline of 13.74%, returning to levels last seen in February 2025.

The collective downturn of mainstream assets seems to be approaching a new critical point.

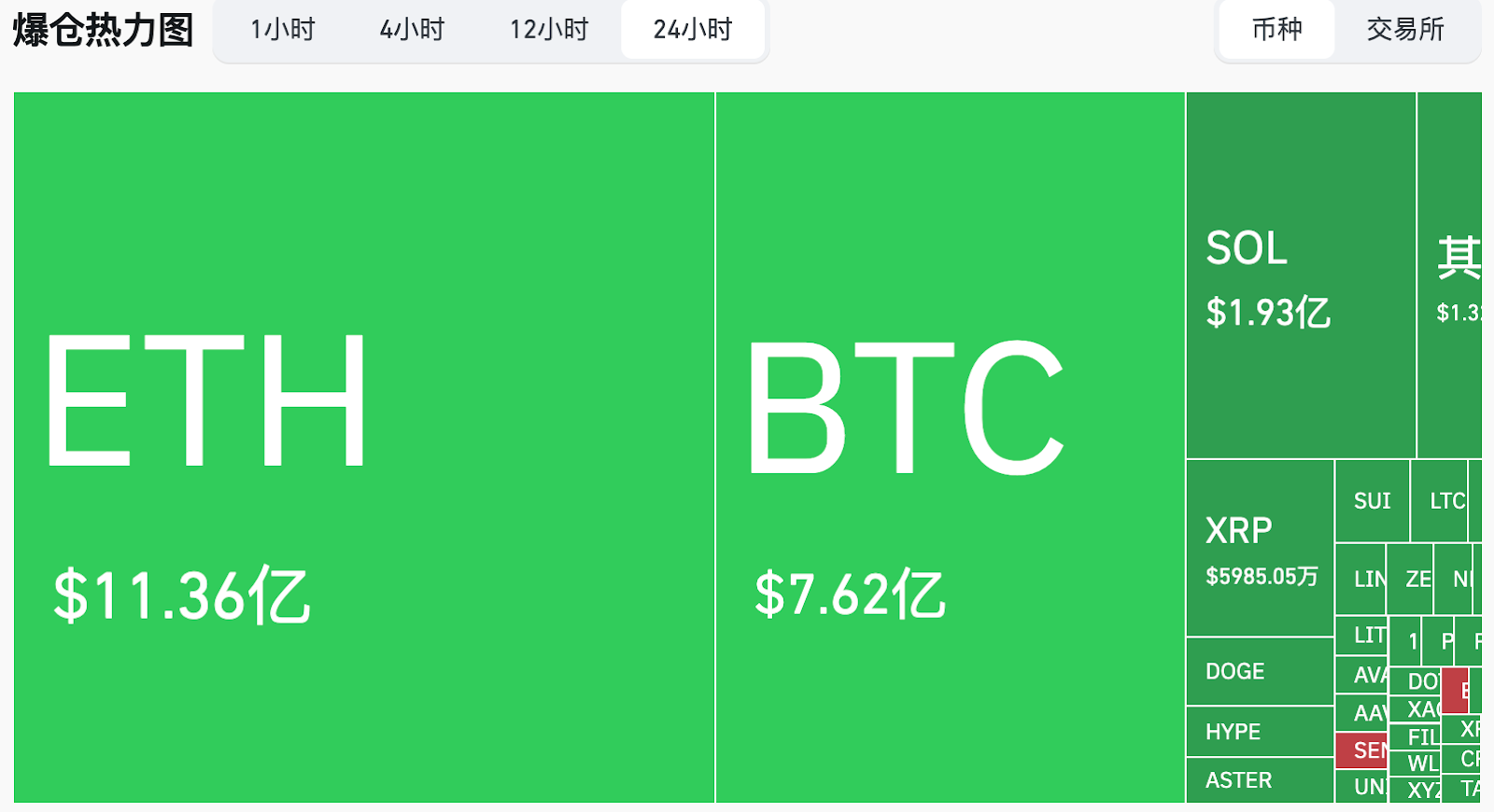

In derivatives, over the past 24 hours, $2.522 billion was liquidated, with long positions accounting for $2.411 billion and short positions $115 million. The largest single liquidation occurred on Hyperliquid - ETH-USD, worth approximately $222 million. Notably, in just the past hour, liquidation amounts reached as high as $1.14 billion.

The Starting Point of the Decline Lies Not Only Within the Crypto Market

The first domino of this round of market movement was not on-chain.

Looking at the timeline, market tension began to noticeably intensify from January 29. The sudden escalation of geopolitical risk was one of the earliest triggering factors captured by the market. The U.S. aircraft carrier USS Abraham Lincoln and its strike group entered a "lights-out" status with communications cut off, while statements from Iran also clearly shifted to a combat-ready posture. Odaily Planet Daily had previously provided a detailed analysis in From Geopolitical Tension to Liquidity Tightening, BTC Dragged into Uncontrolled Market Conditions.

Even so, the speed of this crypto market decline far exceeded expectations. What truly caused the risk to spill over rapidly was the simultaneous crash in the precious metals market.

After Gold and Silver Fell, Crypto's Uncontrolled Decline Accelerated

On January 29, gold turned downward sharply after briefly breaking above $5,600, falling to a low of around $4,740, a maximum drop of 15.7%. The adjustment in silver was even more severe, plummeting after breaking above $120 to a low of $76.6, a maximum drop of 37%.

Dirk Malakie, Managing Director of SLC Management, pointed out that the plunge in gold and silver began with the market's reaction to reports that Trump would nominate Kevin Warsh as Fed Chair. Warsh's resume carries distinct hawkish tones, which somewhat weakened the expectation of a "long-term comprehensive devaluation of the U.S. dollar." The market is re-anchoring towards a more orderly monetary policy path. Related reading: "Estée Lauder Son-in-Law" Kevin Warsh Takes Helm at the Fed, Hawkish Bigwig Turns Out to Be a Crypto Ally?

Seth R. Freeman, Senior Managing Director at GlassRatner Advisory & Capital Group, also believes that the "good news" in this nomination is that the market might not have to repeatedly deal with the uncertainty and emotional disturbance caused by Trump's continuous pressure on the Fed. The sharp fall in gold and silver already reflects the market's repricing for a stronger dollar environment. In his view, it would not be surprising if metal prices fail to show a significant rebound in this context. On the contrary, traders heavily long precious metals without effective hedging may face continued pressure, especially silver bulls. By next Monday, some trading accounts might suffer severe losses.

Additionally, analysts mentioned that month-end concentrated profit-taking trading behavior, and hedging operations by banks to guard against sudden declines, may have amplified the selling pressure in a short period.

Adrian Ash, Head of Research at BullionVault, stated that he has been involved in the precious metals market for 20 years and has never seen a similar行情. However, he downplayed the theory of "retail concentrated withdrawal," pointing out that abnormal fluctuations also occurred in basic metal markets like copper—for example, copper futures fell 4.5% on Friday. If it were only gold and silver, it could be attributed to retail sentiment, but the basic metals market has almost no retail participation.

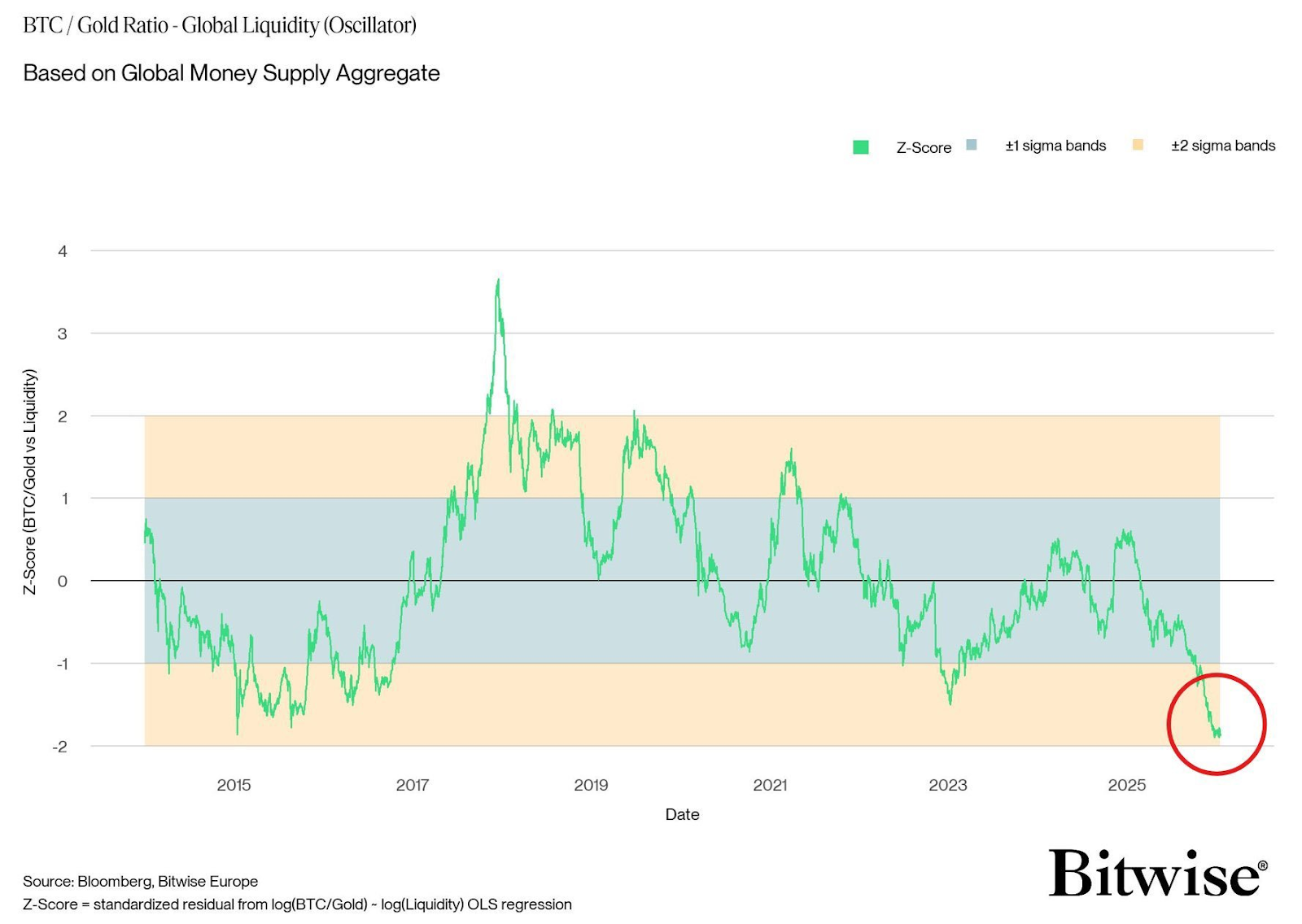

Bitcoin Fell to a Historical Low Relative to Gold

Data from Bitwise Europe shows that the price ratio of Bitcoin relative to gold has fallen to a historical low. This indicator has appeared multiple times in the past near the阶段性 bottoms of Bitcoin.

This implies two coexisting realities: on one hand, Bitcoin is currently weak relative to gold; on the other hand, this extreme weakness also leads some analysts to view the current environment as a potential accumulation zone similar to the pre-bull market launch period of 2015-2017.

The market widely observes that long-term holders are gradually absorbing recent selling pressure. As funds rotate between safe-haven assets and risk assets, some traders anticipate that a阶段性回流 from gold to Bitcoin may occur starting in February.

However, more cautious views point out that fund rotation is not inevitable and requires continuous observation of macro policy, dollar trends, and overall risk appetite changes.

Risk Transmission, Redistribution of Chips

The暴跌 in gold and silver ultimately transmitted to the crypto market. It must be said that the crypto market is now at the bottom of the food chain: when U.S. stocks rise, crypto may not rise; when U.S. stocks fall, crypto often falls deeper; and now, as precious metals fall, crypto cannot escape either. The crypto market seems to have fallen into a "follow declines but not rallies" curse.

In this situation, the "believers" long on crypto assets also seem to be losing their chips in this flood.

Garrett Bullish (@GarrettBullish), the lucky one who made the most profit in the 1011 flash crash, failed to escape this disaster. His position on Hyperliquid was fully liquidated, with a single liquidation规模 exceeding $700 million, leaving his account balance at just $53.68. This was also the largest single liquidation in this event. Data shows that his cumulative loss on Hyperliquid over the past two weeks was approximately $270 million.

On-chain records also show that since starting to use this account for trading in early October 2025, Garrett Bullish's historical cumulative PnL has lost over $128 million.

Behind the liquidations is protocol revenue. After Garrett Bullish's liquidation was completed, the Hyperliquid ecosystem treasury HLP gained approximately $15 million in收益. This single event brought HLP depositors a return of about 5.8%, translating to an annualized yield of about 110%. Data shows that HLP still holds an ETH long position worth approximately $230 million.

The whale高调做多 ETH also seems to be having a hard time. According to on-chain data monitoring, the secondary fund Trend Research under Yi Lihua has currently抵押 175,800 WETH on Aave V3, worth approximately $445 million, and borrowed about 274 million USDT. The liquidation price for the ETH position is $1,558, with a loan position health factor of 1.34. During the market decline, Trend Research continued to add margin. Yesterday, it withdrew approximately 109 million USDT from Binance and deposited it into Aave to reduce the liquidation risk of its Ethereum position.

As of January 29, Trend Research held approximately 651,300 ETH, with an average holding price of around $3,180. Calculated at the current price of $2,400, the floating loss is nearly $500 million.

Conclusion

From the升温 of geopolitical risks to the collapse of precious metals, crypto assets have become the first to be abandoned in this process. Does this indicate that it is not a safe-haven asset and has not yet truly gained the consensus support of a "value anchor,"只能 passively bearing pressure amidst the fluctuations of macro sentiment?

This round of market conditions is forcing the market to re-examine a question: In a deleveraging cycle, what justifies crypto assets being held long-term?